extended child tax credit 2022

You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. Democrats roughly 2 trillion Build Back.

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

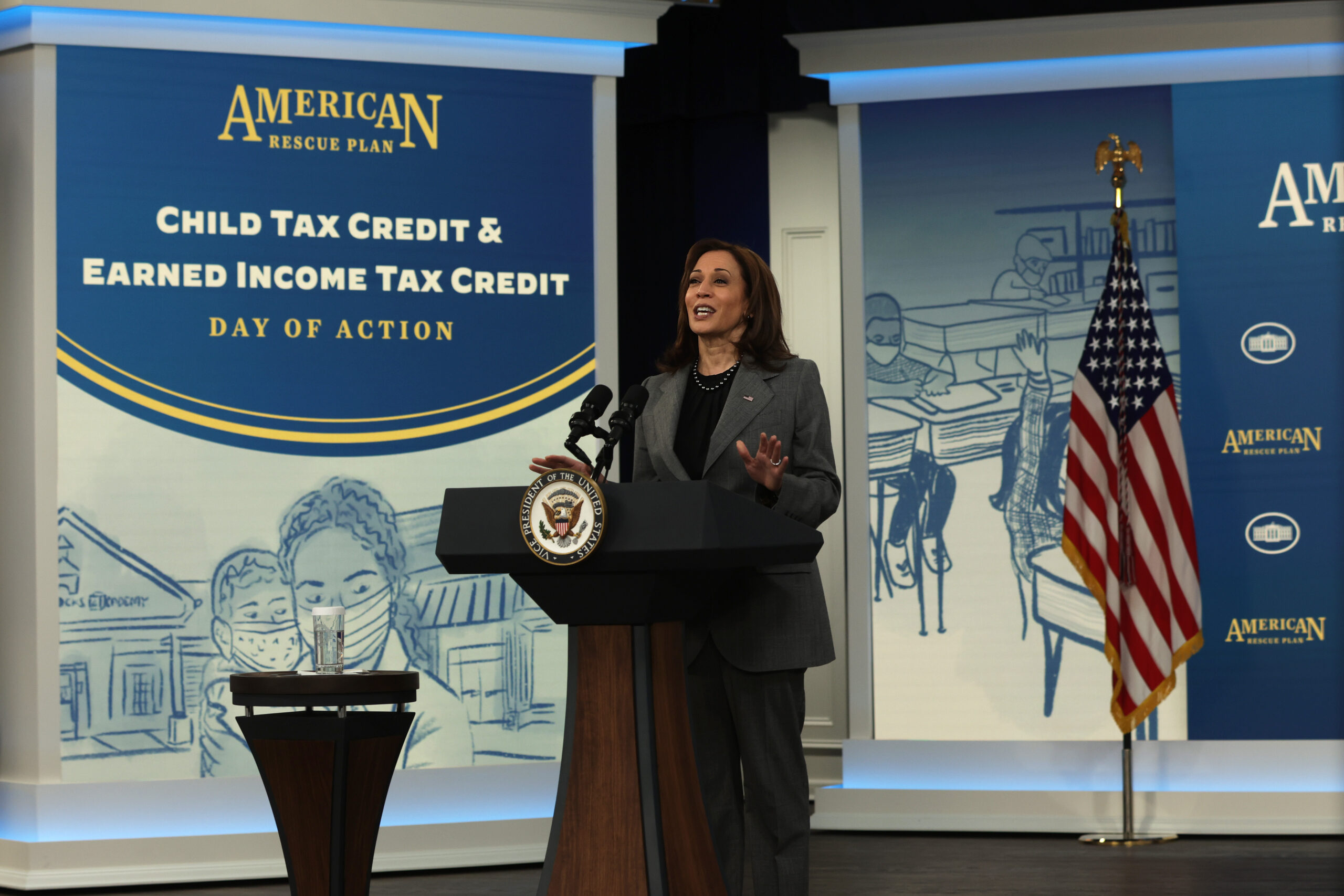

The Child Tax Credit dates back to the 1990s but Congress temporarily expanded it last year as part of the American Rescue Plan.

. The letter F. That includes the late payment of advance payments from July. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of.

Under the expansion eligible families received 3600 for children younger than age 6 and 3000 for those between 6 and 17. For households using full-time ECE average expenditures would decline. Leading the charge is President Joe Biden himself who included a proposal to extend the enhanced child tax credit through Dec.

As such there was. Thus 3600 was offered for a child under the age of six and 3000 for children between the ages of six and 17. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17.

A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for spouses filing a joint return. Since July the federal government has sent the families of 61 million children monthly payments of 300 per child under 6 and 250 per older child.

Suzan DelBene D-Wash released a statement Monday pushing the Senate to take action. For the last six months of. So far the enhanced credit hasnt been back in play even though President Biden has pushed for it.

Parents income matters too. Now if the current payment amounts do not pass in Congress moving forward eligible parents can only receive a once-a-year maximum credit per child come tax time -- 1000 for. Simple or complex always free.

Moreover in the second half of 2021 it became possible to. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of. As part of the 2017 tax overhaul Congress doubled the existing child tax credit to 2000 per child under age 17 at year-end.

The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17. This bill also aims to raise the minimum amount to 255 for the California Earned Income Tax Credit. Some Democratic aides acknowledged it was hard to tout a program that expired under their watch.

For parents who opted out of the advanced child tax credit payments in 2021 they will be able to claim the full credit if they qualify on their 2021 tax return. In the meantime the expanded child tax credit and advance monthly payments system have expired. However there is high support for the direct payments to be extended into 2022.

This credit does have a phase-out amount when you reach 400000 of adjusted gross income if you file married filing jointly or 200000. A childs age determines the amount. 19 hours agoAB 2589 would expand on the Young Child Tax Credit offering a one-time payment of 2000 per child to lower-income families.

In American plan of salvation was accepted into Congress in 2021 while increasing the amount eligible American families can receive from their Child tax credit payments. The latest research from Columbia shows. Lawmakers increased the benefit from 2000 per child per year to a maximum of 3600 per child 5 or younger and 3000 for kids 6-17.

The extended child tax credit lapsed in December. Distributing families eligible credit through monthly checks for. The child tax rebate which was recently authorized by the Connecticut General Assembly and signed into law by Governor Ned Lamont is intended to help Connecticut families with children.

31 2022 in his Build Back Better plan. The maximum credit for taxpayers with no qualifying children is 1502. The American households should have gotten up to 1800 per child in Decembers payment.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500 per qualifying child for children aged six to 17. File a federal return to claim your child tax credit. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

When the child tax credit came to an end in December roughly 37 million more children suffered from poverty according to a study by Columbia University. If you have a newborn child in December or adopt a child you can claim up to 3600 for that child when you file your taxes in 2022. The White House has also suggested that double-checks be sent out to make up for.

2022 Child Tax Rebate. House of Representatives passed the bill just before Thanksgiving. The program previously issued 2000 per child.

In 2017 this amount was increased to 2000 per child under 17. Congress also made the credit fully. The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments.

There are also special exceptions for people who are 18 years old and. 1 day agoThe child tax credit was enhanced as part of President Joe Bidens American Rescue Plan signed into law in March 2021. For many families that meant six monthly payments of 300 or.

That means eligible families will be able to claim the remaining 1800 in their tax returns. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17. A broad expansion of child-care subsidies would substantially reduce the costs that households pay on average for child care.

Check out The. The boosted Child Tax Credit pulled millions of children out of poverty in 2022. It is a dollar.

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit 2022 How Much Is It And When Will I Get It

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Child Tax Credit 2022 Update Americans Can Apply For New Program Now With 750 Direct Payments See How To Claim Cash

/cdn.vox-cdn.com/uploads/chorus_asset/file/23392681/1235261204.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Child Tax Credit 2022 Update Americans Can Apply For New Program Now With 750 Direct Payments See How To Claim Cash

What Families Need To Know About The Ctc In 2022 Clasp

The Expanded Child Tax Credit Briefly Slashed Child Poverty Npr

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca